We’re here to take the hassle off your plate.

Let us handle the filing while you focus on what really matters!

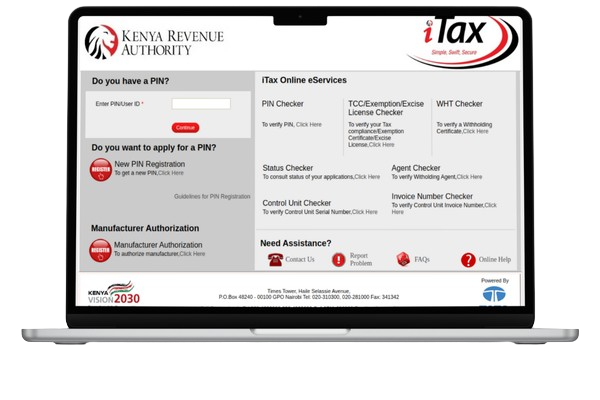

For individuals with no income (unemployed) and students

For employed individuals with a payslip

For employed individuals with a payslip & Withholding Tax

For individuals with a registered business

For corporate & NGO firms

.png)

Know which taxes apply to your business, like income tax, VAT, or payroll taxes. Stay updated with tax changes and ask a tax professional for help to make sure you're following the rules correctly.

Keep your invoices( should be tims/etims), receipts, and employee records organized and easy to find. Follow labor laws and store all your documents for at least five years.

Make sure to file your tax returns on time to avoid penalties and interest.

Identify allowable deductions such as operational expenses and salaries, and maintain supporting documents for audits. Consult a tax advisor to maximize savings and minimize your tax liability.

© Copyright Makabe Consulting